If you are a small business owner, you should know about small business CGT concessions superannuation because these concessions can offer you significant financial advantages depending upon your financial status. Although much of it is your chartered accountant’s work, professionals from mosaic tax legal can be a great help in advising you on proper strategies to get the maximum benefit from them.

There are four types of small business capital gains tax concessions available to you, but concessions depend upon the eligibility criteria which you must fulfill.

Eligibility Criteria

There are a series of CGT concessions available depending on how many criteria you qualify. Some of the primary criteria are as follows:

You must be one of the following:

- A small business entity with no more than two million dollars as your turnover

- You are not carrying on a business but the asset is used in closely connected small business

- You are a partner in the small business and the asset is

- A partnership asset

- The asset you own is not a partnership asset, but it is used in the partnership business

- You satisfy the net asset value test

- The asset satisfies the Active Asset test

- The eligibility criteria are very complex, but with the help of professionals from Mosaic tax legal, you can easily comply the eligibility criteria.

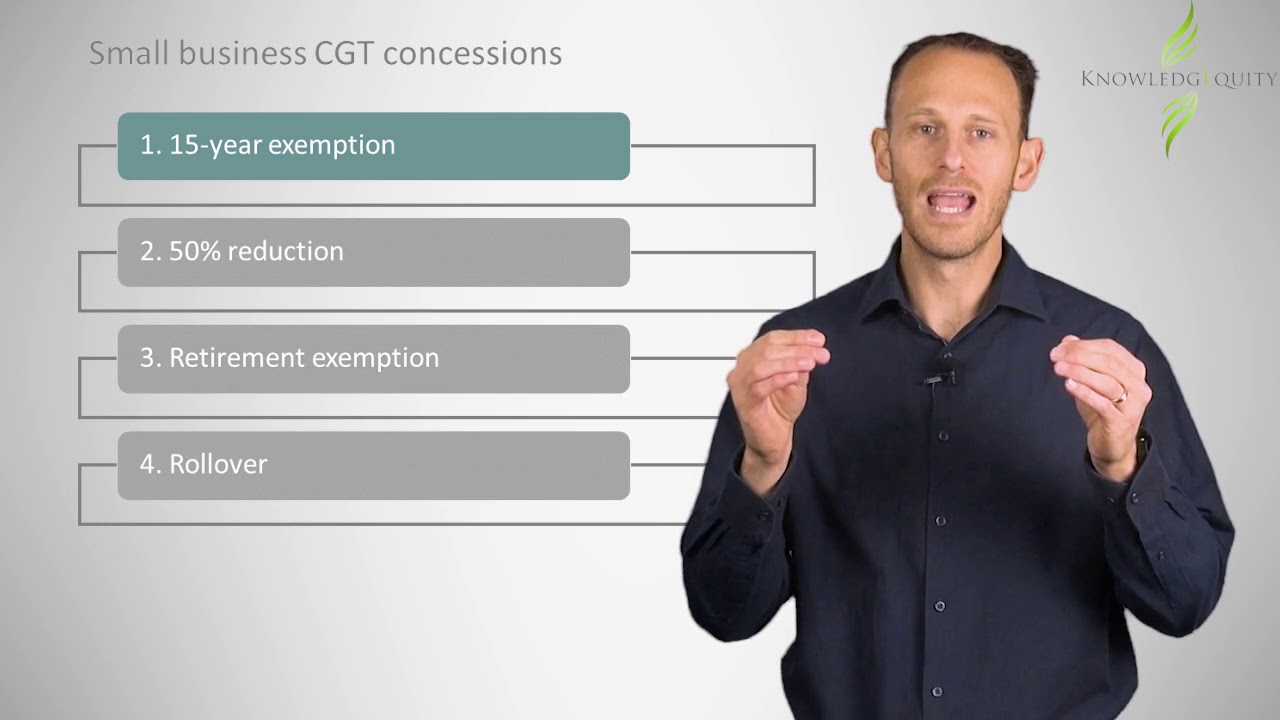

Types of Small business CGT concessions:

There are 4 types of small business capital gains tax concessions from which you may be eligible for one or more of them. It is here that we want you to know that these concessions are available to you as a businessman and if you are selling your business or asset, you can contact at Mosaic Tax Legal for more inquiry and ways in which they can help you save tax and invest in your superannuation fund.

15-year exemption:

This type of exemption is allowed for full 15 years provided:

- The business has been carried out for at least 15 years

- The significant shareholder is at least 55 years of age

- The business or asset is being sold for retirement benefits or the person is permanently incapacitated.

Small Business 50% active asset reduction:

Provided you meet basic eligibility criteria, using this you need to pay only 50% of CGT.

Small business retirement exemption:

If you are below 55, proceeds from the sale of assets have a lifetime limit of $ 500,000 which have to be invested in a complying superannuation fund or retirement fund to save CGT.

Small business rollover tax:

Small business rollover tax allows you to defer the full CGT amount or part of it provided you invest the same into some other asset or business within a period of 2 years.

How CGT concessions can boost your superannuation fund?

Depending on what concessions, you are able to access from the CGT event, a 15-year exemption and small business retirement exemption allows you to invest lumpsum in your superannuation fund without affecting your other contributions.

This way you can defer a significant amount of your liability to your super fund and give your super fund a huge boost for your retirement.

How Mosaic Tax Legal can help you?

Professionals at Mosaic Tax Legal are very cooperative and understanding. They will ascertain from you proceeds and business situation, what concessions you can access and how much you can transfer to your super fund to defer your liability and take advantage of higher earnings with your super fund.